The COVID-19 Economy

Stimulus plans, debt, and a framework for analyzing long-term risk

The past week was another intense one for the world economy and public health. Before sharing major updates covered by the COVID-19 news tracker, I wanted to share a brief framework for how I’m organizing risk and political analysis around this topic.

The importance of time frames

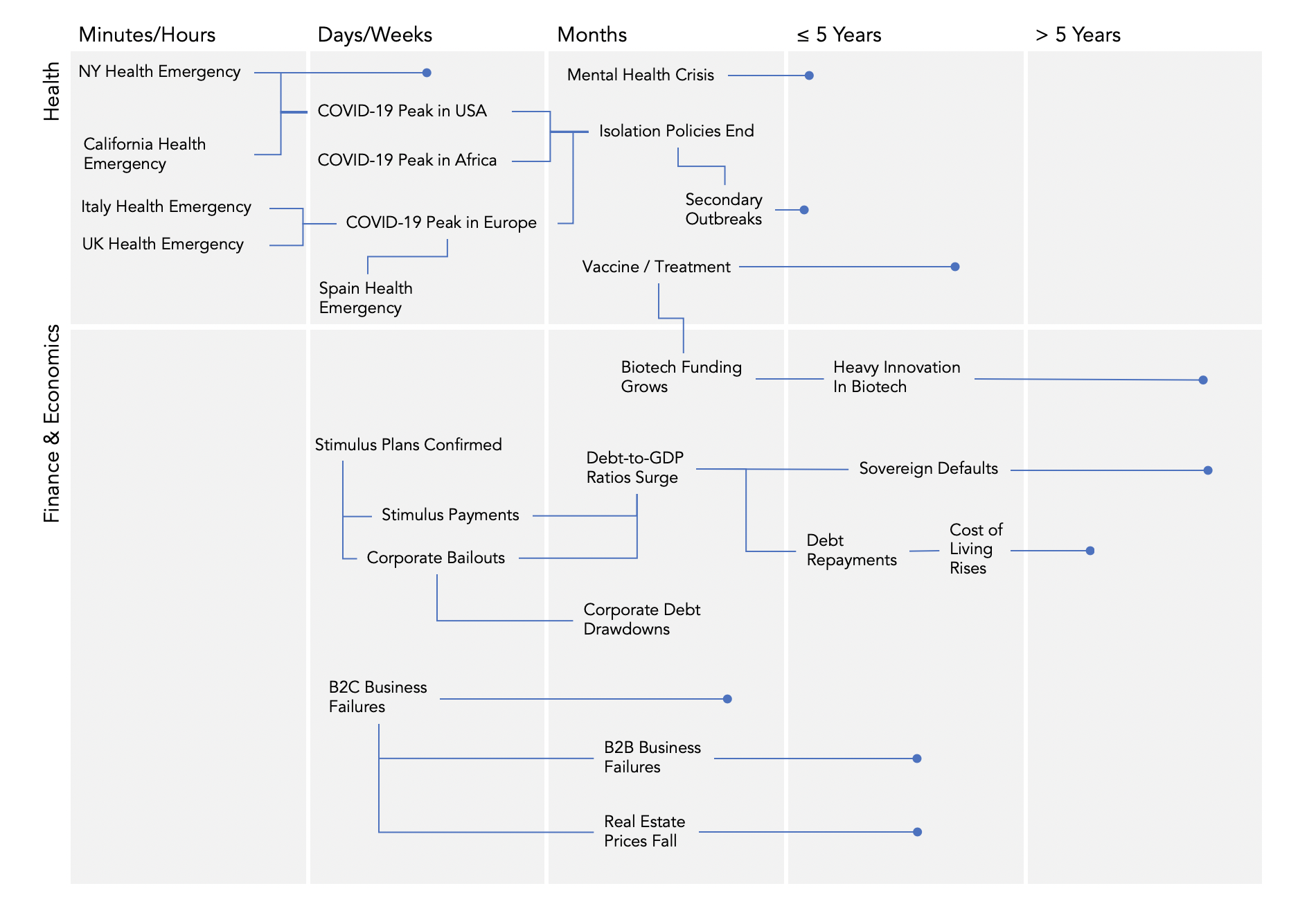

When observing major political, economic, and health developments, I split my analysis into news across five time-based categories:

- Minutes/Hours

- Days/Weeks

- Months

- ≤ 5 Years

- > 5 Years

When I read the news, I try to ask myself which time frame the news is affecting, and how this impacts the stakeholders/leaders in the news.

For example, the health emergency associated with COVID-19 focuses on the minutes, hours, days, and weeks... New York City needs to respond as soon as possible; every hour counts.

This is less true for the US stimulus plan. We didn’t need a minute-by-minute response there, and in fact would prefer a well-planned response over days/weeks instead.

Crises that have an impact over shorter timeframes tend to have lower quality of information and fast-changing facts. The quality of information is loooow in the events changing in minutes/hours because few people have time to run any sort of analysis or fact-checking. By the time you’re reading this newsletter, some of the news might be outdated (which is why you should check regularly-updated dashboards); our political leaders might seem wishy-washy because they’re responsible for minute-by-minute decisions and are using low-quality information.

This is important to keep in mind when making your own plans.

Now... On to the news for this past week.

A Summary of Last Week's News

Are we in a recession? Yes. ... and to those that say we're technically not, I’d say you're missing the point.

The biggest financial news this past week was the US CARES act (i.e., the $2 trillion stimulus plan):

- It was passed after days of negotiations between Democrats and Republicans.

- CNN reports that student loans will be delayed, mortgage and credit card payments can be put on hold, households earning under $75K annually will receive stimulus cheques, and more.

- $500B will be held for loans and loan support programs for businesses.

- Hospitals will receive $117B (after threats of shut-downs and operational issues).

- Gig workers and freelancers will have access to fund as well, even though they’re not traditionally eligible for employment insurance or benefits. This will set an important precedent for post-COVID-19 social policies.

Other countries have also passed bills or stimulus plans:

- The European Union is still debating additional stimulus plans, and looking for proposals.

- This is causing stress and anxiety, with member states complaining about the EU's lack of effectiveness in times of crisis.

- Note that to my earlier point above, I personally think it's OK to take a days/weeks-long approach to determining next steps, especially given the EU's earlier €750B plan.

- Individual countries do have their own stimulus plans (e.g., France - $50B, Italy - $28B, Poland - $52B).

- Japan is now exploring a $526B stimulus package. This is particularly interesting given the relatively small impact COVID-19 has had on its economy, so far.

- China is creating a stimulus plan but details are not public yet.

- Canada's $52B bailout, announced early last week will lead to a $112B budget deficit in 2020

- South Korea has an $80B stimulus plan focusing mainly on business continuity and providing liquidity to companies and markets.

The US-based Tax Foundation is tracking country stimulus plans systematically.

Corporate playbooks are starting to show a pattern: (1) stop paying dividends, (2) increase your access to cash via debt, lines of credit, or other means, and (3) restate earnings projections or simply stop committing to any.

Companies following this playbook include GM ($16B credit facility, 2020 guidance changes), Airbus ($15B credit facility, no more dividend payments), Boeing ($13.8B loan drawdown), Vale ($5B credit line), Orbia ($1B credit line), and many others.

In fact, the FT reports that investment-grade companies took on $244B in debt since March began.

There’s much more news, but the patterns above are becoming clear and hopefully will help guide your own reading and analysis.

What’s coming up...

Let’s return to the framework I mentioned earlier, and let’s see how major trends and patterns stack up for the coming days, weeks, and longer-term periods. Below are some of the trends I’m monitoring.

Click here to get a full resolution PDF.

This isn’t meant to be an exhaustive list, but more to help you potentially build your own.

Good luck this coming week. The WSJ says it's a "make or break week" for America. If there’s anything I can help with or provide information on, please let me know.

Sign up for our newsletter

Receive updates around stats, news, and analysis.